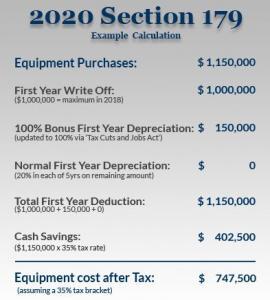

With the Section 179 Tax Code, It Is Now Cheaper Than Ever To Upgrade Your Equipment

Save Up To 35% On Machines Purchased This Year!

IRS Section 179 tax code allows businesses to deduct the full purchase price of qualifying equipment from their gross income up to $500,000 including 50% bonus depreciation. This includes nearly the entire Takeuchi product line including Wheel Loaders, Excavators, Skid Steers, and Track Loaders.

- Deduct up to $500,000 of the purchase price of a new machine this year

- Bonus depreciation is 50% of the remaining cost after write-off on a new machine

- Apply the additional standard depreciation of 20% per year over five years

- Read more about Section 179

* This information should not be considered tax or legal advice. Contact the IRS or your tax adviser for additional details.